Charts For Freedom

Taking a Step Back: A Message to My Subscribers

Dear All,

I'm announcing a pause in my regular postings and the discontinuation of the paid service on this platform. This break allows me to focus on new endeavors and personal commitments. I'm immensely grateful for the support and engagement from all of you over the years. Please stay tuned for occasional updates and insights, as I will continue to share my thoughts and experiences, albeit less frequently. Thank you for being a part of this incredible journey.

Portfolio Success (Updated as of 12/31/2023):

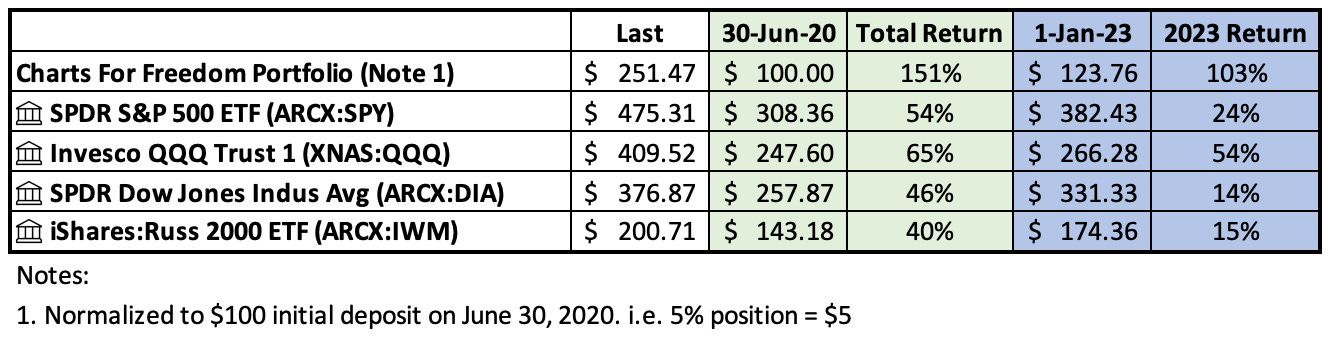

Final Returns vs. Major ETFs

Since we started, the portfolio has come a long way, with a +151% cumulative performance, significantly outpacing the +51.5% average return of the four major ETFs.

In 2023, the portfolio value doubled, realizing a return of +103%. In the same period, the combined average return of the four major ETFs was +27%, significantly boosted by QQQ's +54% gain.

Options Success (Updated as of 12/31/2023):

In 3.2 years, 112 trades were made, averaging a 120-day holding period and yielding an annualized return of 17%, outperforming the SPX's 12% in the same period. These results reflect my trading approach and strategy.

I hope this service has been both beneficial and informative. For long-term subscribers, your continuous support has been crucial and is greatly appreciated.

Today marks the end of the paid service on Substack. Pro-rated refunds are being processed through Stripe and should be completed within about 10 business days.

Future Returns

While I can't promise the moon when it comes to future returns or performance, what I can swear on is that I'll keep using my tried-and-true strategies, keeping my eye on the ball to spot and get set for the next big market shifts.

If I ever did encounter anyone who claimed to guarantee future returns, I would quickly distance myself from them because such a claim is simply impossible.

A weekly analysis (with occasional mid-week updates) of the stock market and cryptocurrencies, Charts For Freedom blog posts are written by StockTwits user @TraceBusta (Twitter handle @TraceBustaChart). I have a passion for the markets and believe this is my true calling. During my market journey over the years, I have spent countless nights and weekends charting, studying, researching, and fine-tuning my analysis to find the simplest ways to analyze the markets and their respective charts for capital appreciation. My weekly updates provide a unique mix of charting techniques and ideas that have allowed me to maximize time with family & friends and leave time for hobbies while comfortably being exposed to significant market trends. I would be honored to have you join along on the future journey.

Objective: A unique and straightforward approach to charting the financial, commodity, and Crypto markets by identifying the prevailing trends and utilizing Point and Figure counting. I seek high probability setups and look to ride major trends for as long as possible.

Actionable ideas: Every week, I scan the markets for good chart setup ideas and add my thoughts on the selection process explaining why I believe the ideas may present favorable opportunities for my trading/investing account(s).

Charting methods: Clean and simple. I provide analysis on traditional bar/candlestick charts, in addition to “Point and Figure” (PnF) charts, that I will use to make my trading and investing decisions.

About Point and Figure charts: Most people are scared or confused by PnF charts, but this is one of the most valuable tools a trader/investor can have! Knowing how to count PnF objectives and gauging how much “gas is in the tank” before placing a trade is of paramount importance. I believe it gives a tremendous market edge when paired with the more traditional bar/candlestick charts. PnF is, in my opinion, the simplest and fastest way to eliminate the “noise” and chop that is presented in a traditional bar chart. A bonus of PnF charts is the “objective 45°” trend line, which from my experience, has kept me in solid trends and provided great entry points for successful trading. I share many PnF charts and explain how my objectives (“targets”) are counted.

Lessons learned: Over the years, I have learned the harsh lessons the market teaches and have paid a hefty price, or “market tuition,” as some call it. After being humbled many times, I finally buckled down and learned what mistakes caused me to lose money, and I avoid repeating those mistakes. I will share my painful lessons with the hopes of helping others to avoid them.

Why subscribe?

Subscribe to get full access to the weekly updates (and sometimes mid-week) updates. Never miss an update.

Stay up-to-date on Actionable Ideas.

You won’t have to worry about missing anything. Every new blog post with my actionable ideas and market analysis goes directly to your inbox.

Join the crew

Be part of a community of people who share your interests.

Scheduled weeks off:

Each year, I plan on taking several scheduled weeks/weekends off, plus a flex week:

Easter Weekend

Thanksgiving Week

Christmas Week

Flex week between June-October

Thank you for understanding,

Disclaimer:

Charts For Freedom LLC, “Company,” and all associated persons and publications, newsletters, commentary, and social media feeds is not an investment advisory service, nor a registered investment adviser or broker-dealer and does not purport to be or to tell or suggest which securities, investments or currencies individuals should buy or sell for themselves. Charts For Freedom is a weekly financial publication and is for informational purposes only. It provides only general, disinterested and non-specific commentary and is not recommended to buy or sell any securities or make any investment decisions. Charts For Freedom operates under an exclusion from the definition of an investment adviser because a) it offers only “impersonal advice,” i.e., advice not tailored to the needs of a specific client, group of clients, or portfolio; b) the publication is “bona fide” and contains only disinterested commentary and analysis, and no promotional material, or information distributed as an incident to personalized investment services; and c) this publication is of general and regular circulation and is not issued from time to time in response to episodic market activity or events affecting the securities industry. The information provided in any correspondence, publications, websites, or social media feeds and accompanying material is for informational purposes only. It should not be considered legal or financial advice. Data and information provided are for informational purposes only.

This investment blog (the “Blog”) is created and authored by “Trace Busta” (the “Content Creator”) and is published and provided for informational purposes only (collectively, the “Blog Service”). The information in the Blog constitutes the Content Creator’s own opinions. None of the information contained in the Blog constitutes a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. You understand that the Content Creator is not advising and will not advise you personally concerning the nature, potential, value, or suitability of any particular security, portfolio of securities, transaction, investment strategy, or other matter. To the extent any of the information contained in the Blog may be deemed to be investment advice, such information is impersonal and not tailored to the investment needs of any specific person.

THE CONTENT CREATOR, ITS AFFILIATES, AND PARTNERS SHALL NOT BE LIABLE FOR ANY DAMAGES OR COSTS OF ANY TYPE ARISING OUT OF OR IN ANY WAY CONNECTED WITH YOUR USE OF THE SERVICES OF ANY BROKERAGE COMPANY. THE BLOG AND THE CONTENT ARE PROVIDED “AS-IS,” AND THE CONTENT CREATOR, ITS PARTNERS, AND AFFILIATES, DISCLAIM ANY AND ALL REPRESENTATIONS AND WARRANTIES, WHETHER EXPRESS OR IMPLIED, INCLUDING IMPLIED WARRANTIES OF TITLE AND MERCHANTABILITY, IF APPLICABLE, AND FITNESS FOR A PARTICULAR PURPOSE OR NON-INFRINGEMENT. THE CONTENT CREATOR CANNOT GUARANTEE AND DOES NOT PROMISE ANY SPECIFIC RESULTS FROM THE USE OF THE BLOG.

No one should make any investment decision without consulting their financial advisor and conducting their research and due diligence. To the maximum extent permitted by law, ”Company” disclaims any and all liability in the event any information, commentary, analysis, opinions, advice, and/or recommendations prove to be inaccurate, incomplete, or unreliable or result in any investment or other losses.

To find out more about the company that provides the tech for this newsletter, visit Substack.com.